Foreign Companies in Spain: Sectors with the Most Success and How to Obtain a NIF

Why Foreign Companies Choose Spain

Imagine you’re running a German renewable energy firm that wants to sell solar panels in southern Spain, or a French tech startup planning to open a branch in Madrid. Spain is not only strategically located in Europe but also a bridge to Latin America and North Africa. Add to this a skilled workforce, a large domestic market, and tax agreements with dozens of countries, and you’ll see why so many businesses want a foreign company with Spanish NIF.

Spanish tax law is relatively straightforward compared to other EU countries, especially regarding the application for NIF foreign company. With the right documentation, companies can be up and running in just a few days.

Most Promising Sectors for Foreign Investment

-

Technology & Innovation: Barcelona’s “22@ district” and Madrid’s financial hub are magnets for startups in software, AI, and cybersecurity. These businesses need to obtain NIF Spain for a foreign company before opening a local bank account or signing contracts.

-

Renewable Energy: A German wind farm operator, for example, cannot bid for public contracts without a foreign company NIF Spain.

-

Tourism & Hospitality: From boutique hotels in Seville to travel agencies in Mallorca, every foreign company with Spanish NIF VAT can legally invoice and pay taxes.

-

Real Estate: A Canadian investor buying apartments in Madrid must apply for NIF foreign company to pay property taxes and register deeds.

-

E-commerce: International sellers on Amazon Spain or Shopify need a foreign company with Spanish NIF to declare VAT.

Steps to Obtain a NIF in Spain

-

Application: File form 036 at the Spanish Tax Agency.

-

Documentation: Articles of incorporation, ID of the legal representative, sworn translations if needed.

-

Without Permanent Establishment: Even if you don’t plan to open an office, you can still obtain NIF foreign company without permanent establishment.

-

VAT Obligations: A foreign company with Spanish NIF VAT must file quarterly tax returns.

Common Mistakes (and How to Avoid Them)

-

Sending incomplete documents (always double-check translations).

-

Forgetting to verify NIF foreign company on the Tax Agency’s website.

-

Operating before being registered → results in fines and delayed contracts.

💡 Tip: Always keep scanned and paper copies of every document you submit. It saves weeks if authorities request verification later.

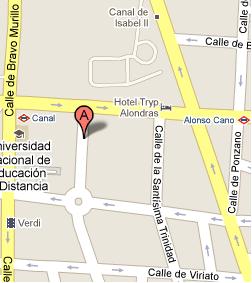

Why Work with a Madrid Consultancy?

Setting up on your own can be slow and frustrating. Many companies lose months trying to understand the process. A specialized consultancy in Madrid makes it faster, cheaper, and safer. For example, our team recently helped a Dutch logistics company get their foreign company NIF Spain in less than 5 days.

Conclusion

Spain offers golden opportunities in technology, renewable energy, tourism, real estate, and digital trade. But the key to unlocking this market is the application for NIF foreign company. With professional guidance, what could take months can be resolved in days—allowing your business to focus on growth instead of paperwork.